Summary

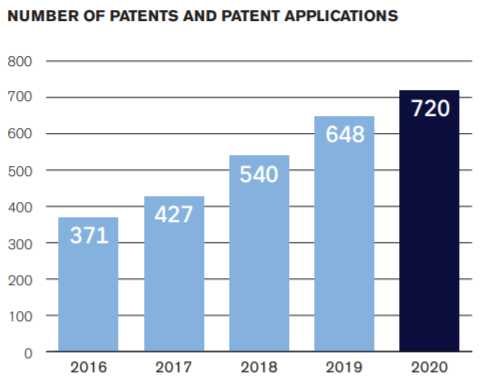

Tobii SA (the Company) is a Swedish technology company that develops and sells eye-tracking technology and solutions.

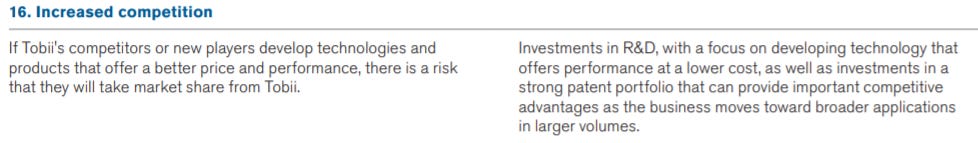

The Company has a vast eye-tracking technology patents portfolio which power a comprehensive range of eye-tracking devices and hardware platforms.

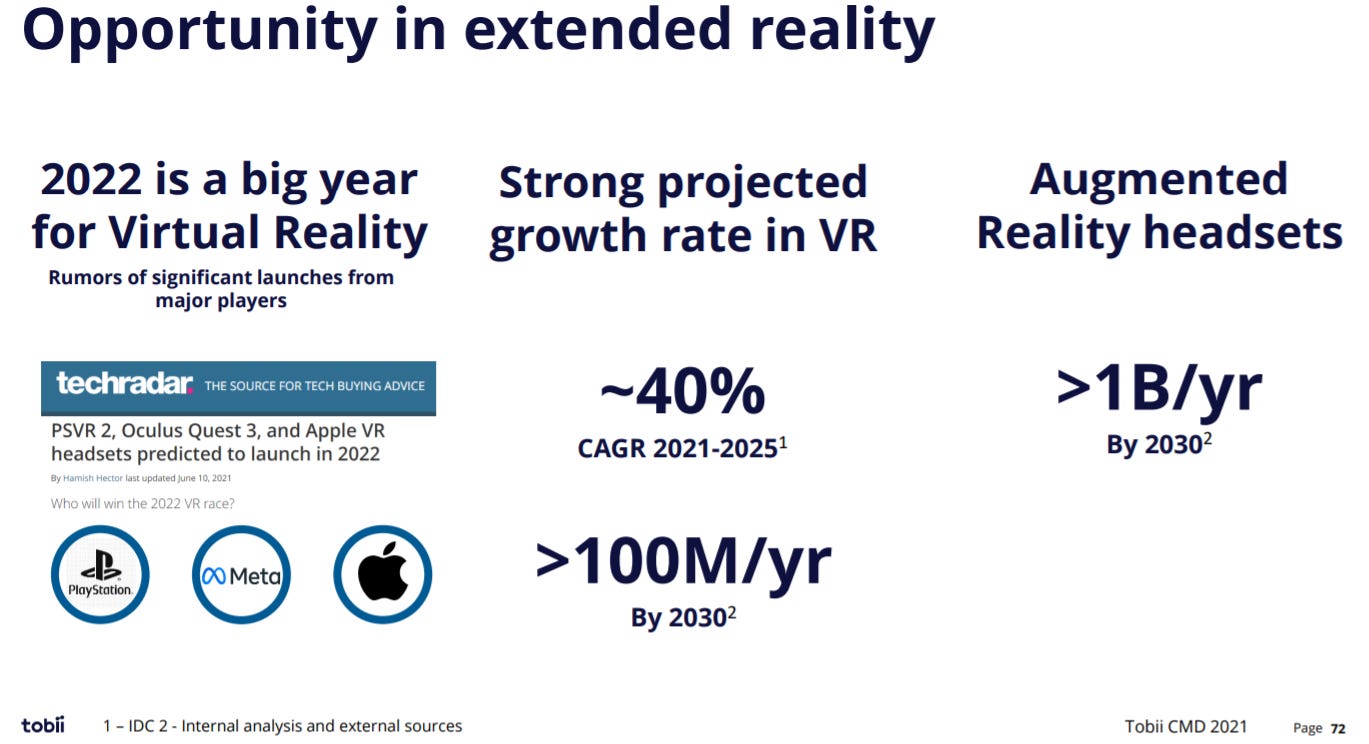

The Company appears to have a dominant position in a market that is on a secular growth with the advent of Virtual Reality/Augmented Reality.

Industry Overview

The Technology behind Eye Tracking

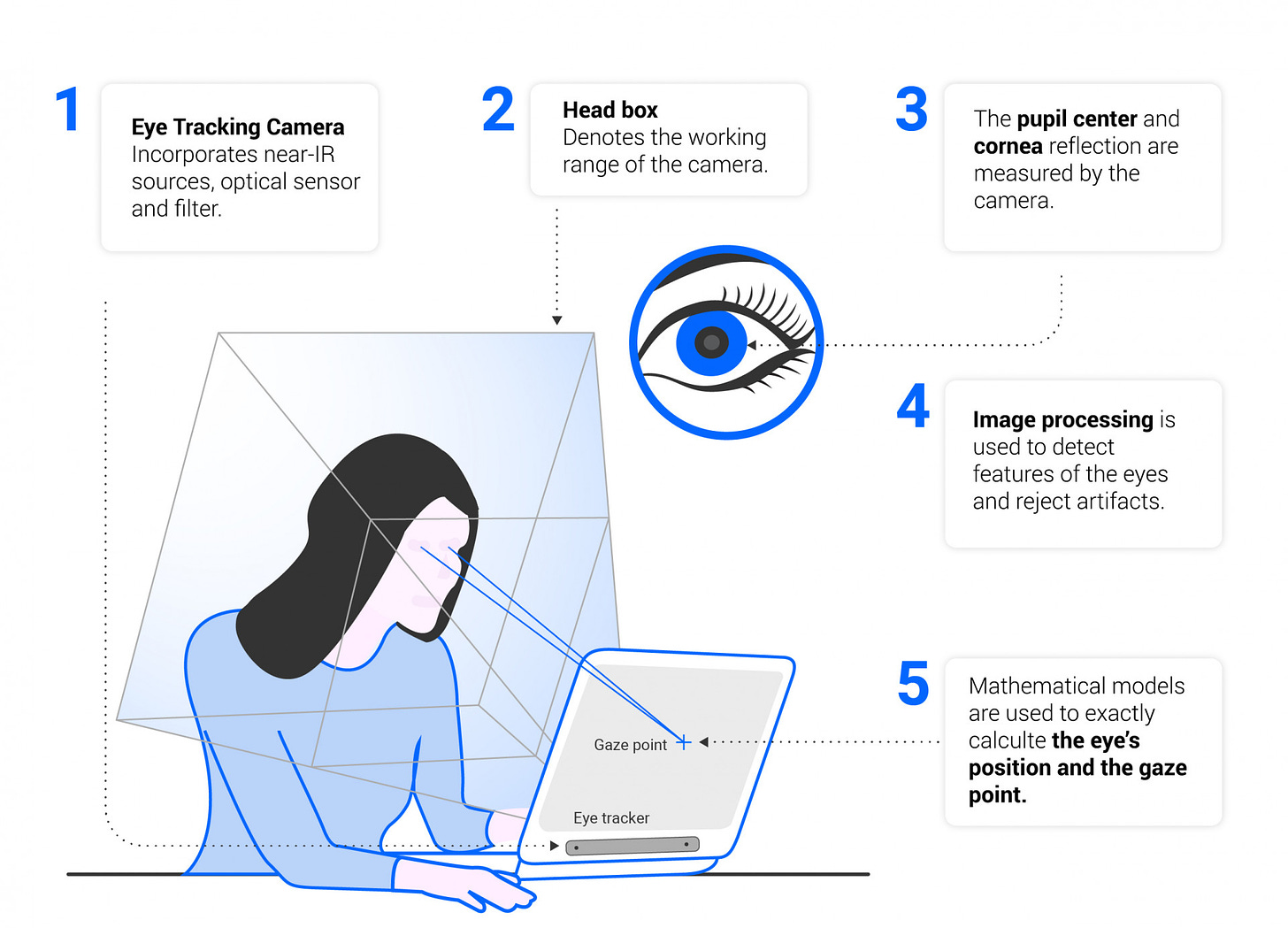

Eye tracking is a sensor technology that can detect a person’s presence and follow what they are looking at in real-time. Essentially, the technology decodes eye movements and translates them into insights that can be used in a wide range of applications or as an additional input modality.

This is made possible using cameras (hardware) that collects images of the user’s face (raw data), then passing it through algorithms (software) that translate the camera feed into data points with the help of machine learning and advanced image processing.

Below, I have listed some resources I used to (try to) understand the underlying technology:

It is quite a bit to go through so I can summarize eye tracking to the best of my understanding as such: There is nothing new about the technology behind eye-tracking. In fact, much of it has already been commoditized. For example, the integration of eye-tracking into AR/VR headsets is already being done by multiple companies already.

Eye Tracking Applications

Obviously, the applications for this technology are vast:

Consumer

Gaming

Metaverse

Streaming

Enterprise

Performance assessment

Maximize learning experience from on-site training

Healthcare

Assessment and therapy

Development of tools for brain and behavioral health, reading and learning, as well as vision and ocular disorders.

Medical technology

Control of surgical robots, diagnostic imaging equipment, and other medical displays.

Assistive technology

Communication and access devices, as well as vision aids.

Academia

Marketing and User Research

Product placement

Packaging design

Advertising

User experience

Scientific Research

Law Enforcement and Regulations

Police body cams can use eye tracking to warn officers of suspicious behaviours from detainees and provide more granular evidence for investigations

Vehicle makers may be mandated to install eye-tracking technology on their vehicles to ensure that drivers are not distracted.

It’s clear that there are many aspects of society and economy that eye-tracking technology can be applied to, with varying degrees of actual need.

Types of Eye Tracking Devices

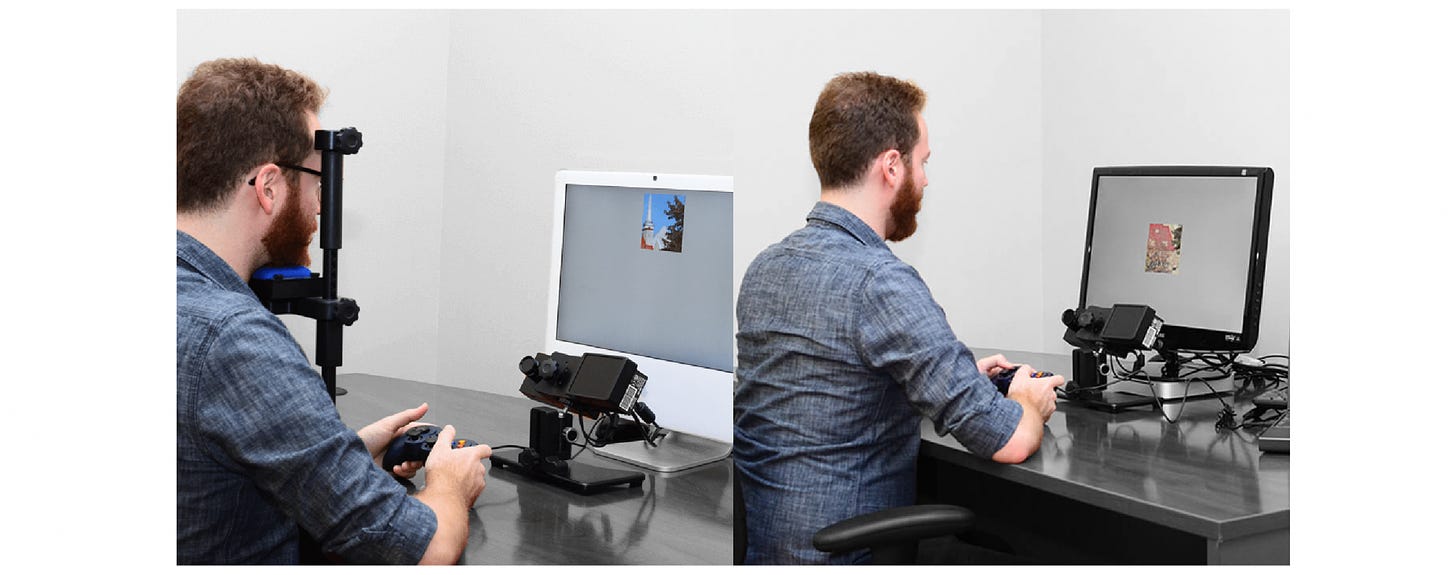

Head-Stabilized Eye Tracking

Typically for high-fidelity experimental research that requires maximum accuracy.

Remote Eye Tracking

Suited for wide-spread use.

Mobile Eye Tracking

Integrated or Embedded Systems

For AR/VR devices

Competition

The Company claims it is the market leader for this growing technology. However, it does not mention the sources for these statistics.

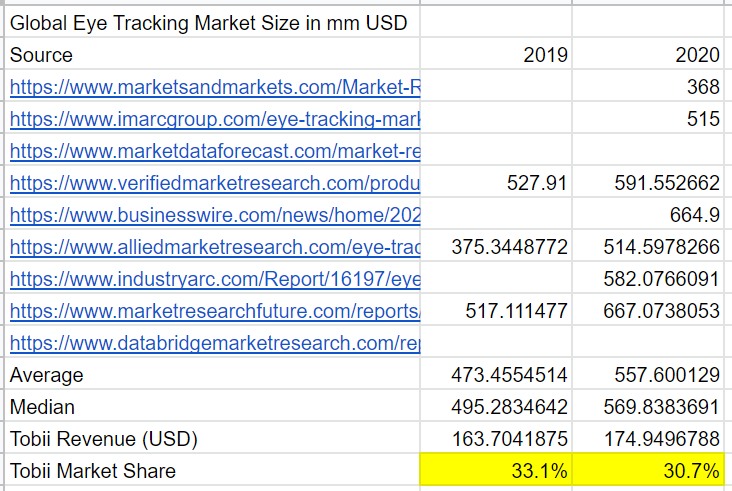

I have not been able to find public data to verify this but using rough estimates by comparing their revenues to the market size expectations by research services suggest that they may be overstating their claims. Note that I am using the end-of-year USDSEK value to convert Tobii sales to USD. That being said, FX should not be able to explain the 10% differential from its lowest mentioned market share.

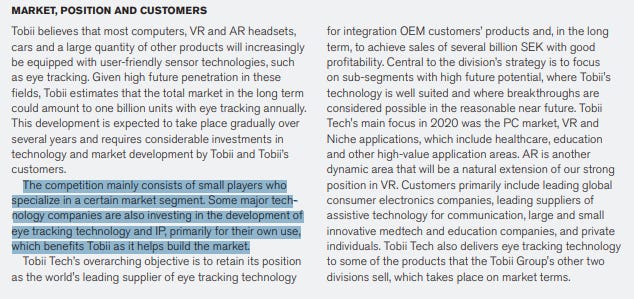

According to the Company’s FY2020 annual report, they claim that they and a few big tech players are among the incumbents of the industry, with many other small competitors in specialized areas.

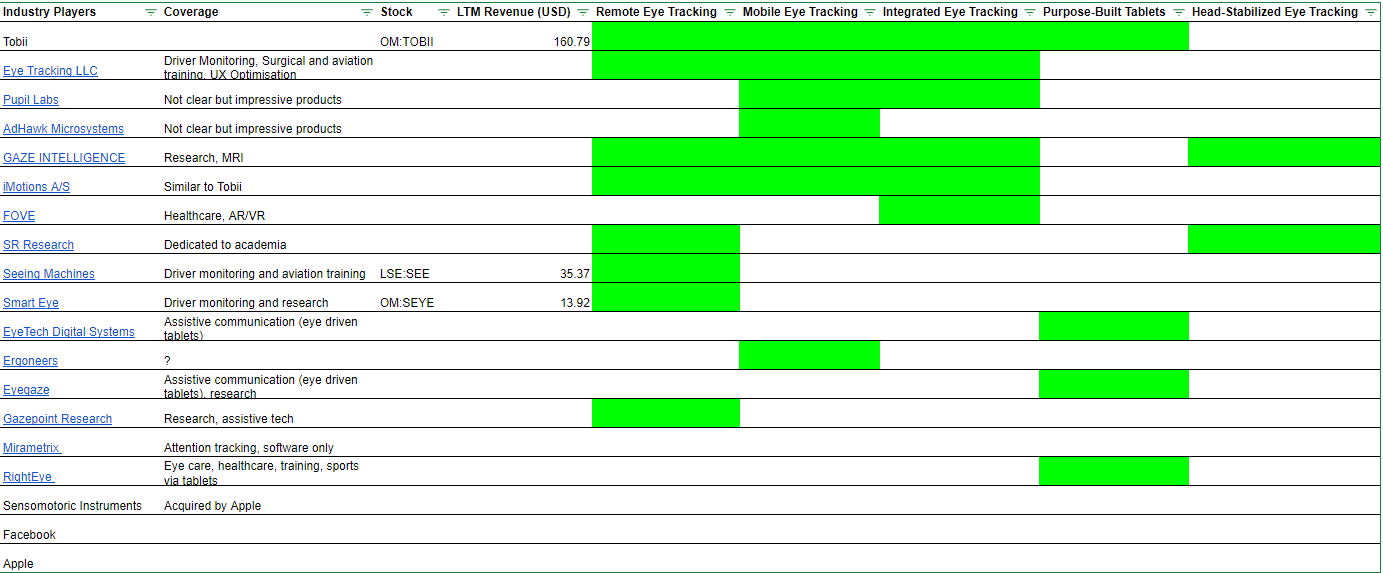

I have curated a list of competitors in the space and found a list of 4 competitors with a similar product line, excluding Facebook and Apple.

This gives me reason to believe that Tobii has a leading market share due to comparatively better products based on functions or specifications, which frankly speaking, competitors will likely be able to catch up to in the future if the Company does not continue to reinvest into its business.

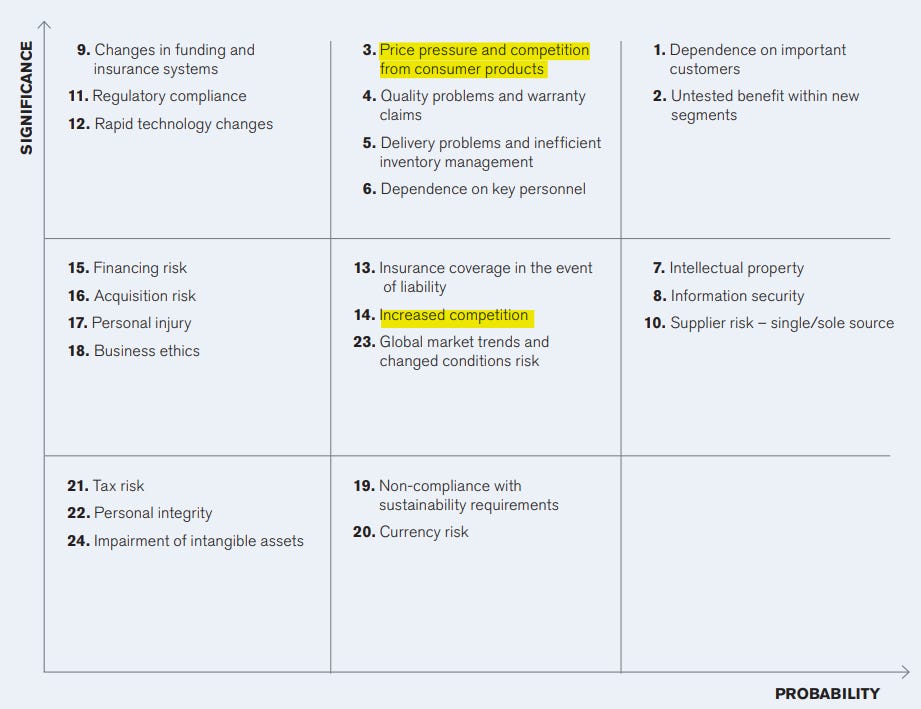

Management’s assessment of risks seems to support this view.

More specifically:

Business Overview

Tobii’s core asset is their ever-growing patent portfolio of eye-tracking technologies and its applications.

This portfolio has been continually growing over the past two decades through in-house research and development, as well as strategic acquisitions.

This vast patent portfolio is monetized via two lines of business:

End Customer Solutions

OEM Integration Solutions

Tobii was formerly comprised of 3 business division: Tobii Pro, Tobii Dynavox, and Tobii Tech. Dynavox has since been spun off, with Pro and Tech going through an organization merger. Some details on what business activities of these divisions below:

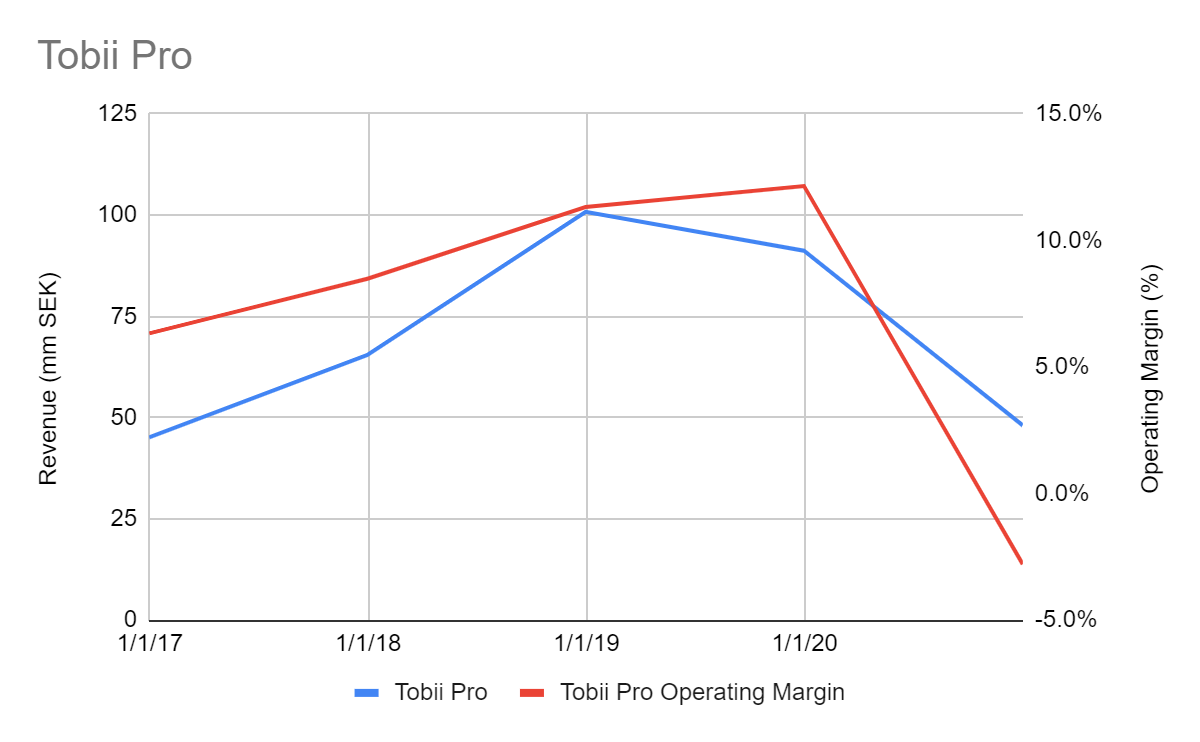

Tobii Pro

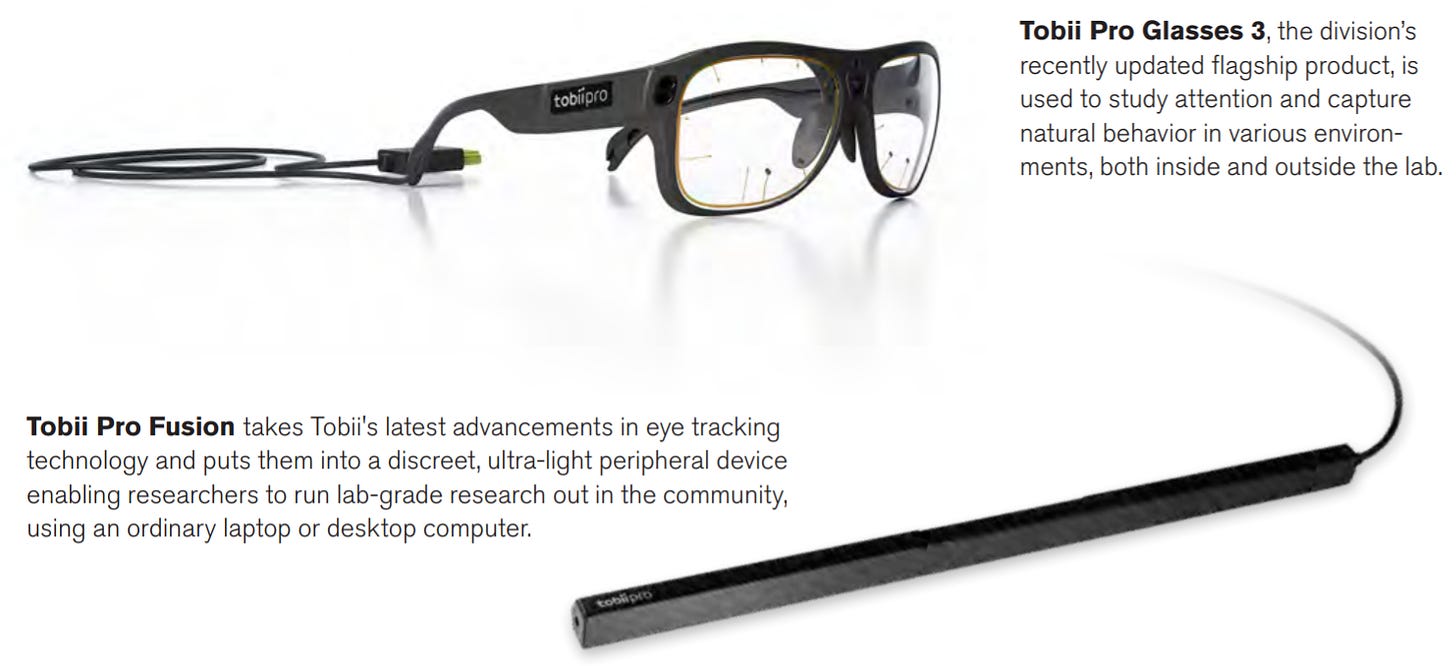

Tobii Pro is a supplier of eye-tracking solutions dedicated for research purposes.

The core products for Tobii Pro are a range of eye-tracking hardware along with software that provides scientific researchers and business professionals with insights into human behavior through the use of world-class eye tracking technology.

These products come along with a dedicated analysis software, Tobii Pro Lab, which guides and supports the customer through the entire research workflow from simple to complex experiments.

The products are sold through four different channels:

Direct sales

Research consultants commissioned by companies

Integration partners who combined eye tracking technology with other research tools to enable a combination of data streams

Channel partners served by Tobii Pro’s own research consultants

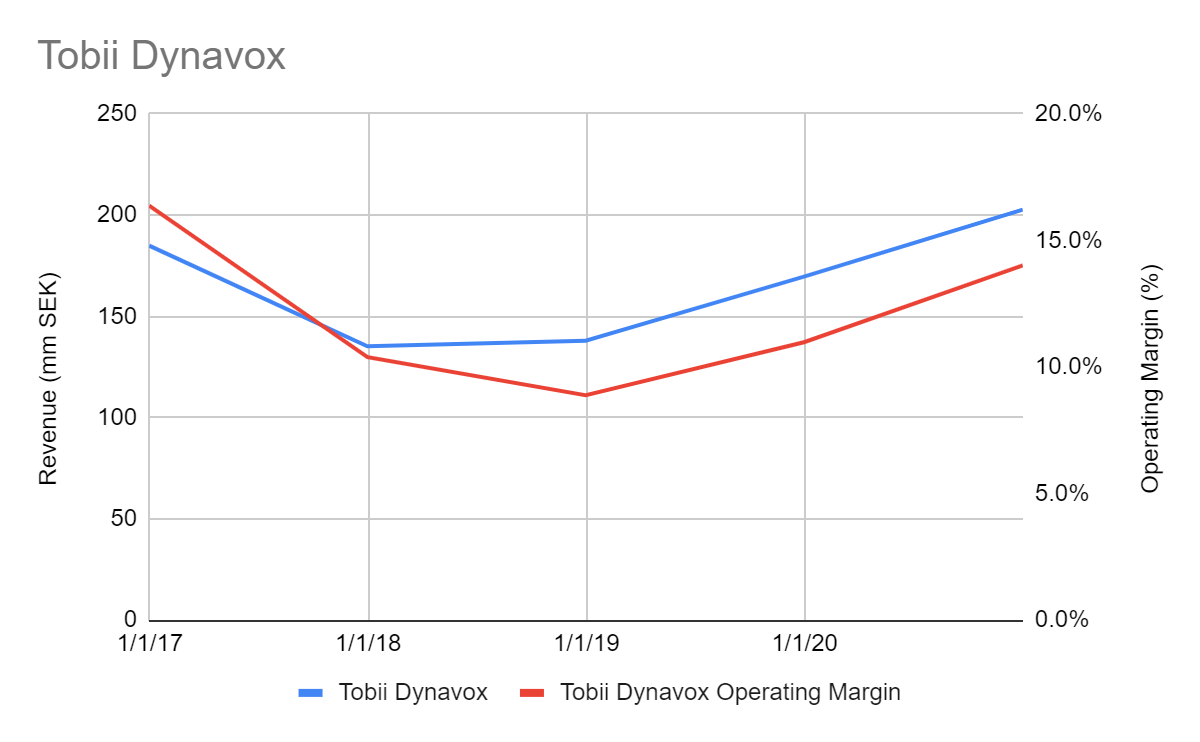

Tobii Dynavox (Spun off)

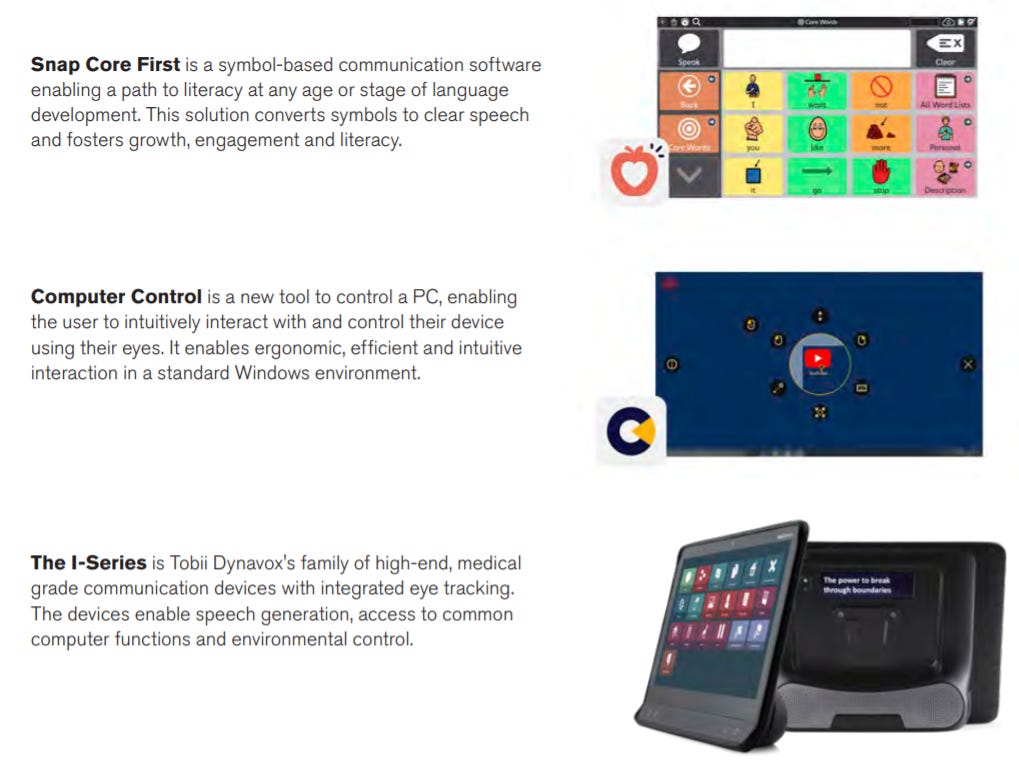

Tobii Dynavox is a supplier of assistive technology for communication.

Most users are unable to speak by themselves during a variety of medical conditions such as cerebral palsy, spinal cord injuries, ALS, autism and aphasia. Tobii Dynavox products enable them to communicate by allow users to use their eye movements to form their messages.

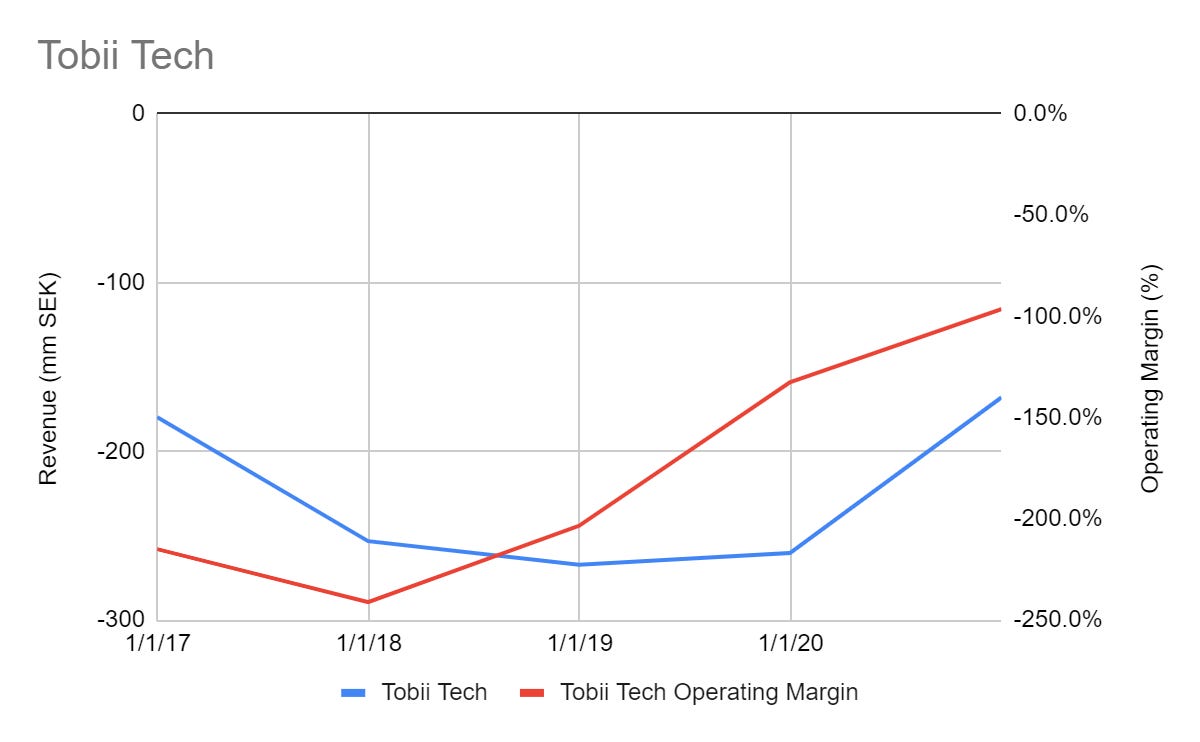

Tobii Tech

Tobii Tech supplies their eye-tracking technology to a wide range of OEM customers and partners for integration into a variety of products. This division arguably has the most growth potential as the products are not standalone, but rather integrated with more wide-scale products.

Tobii Tech’s offerings mainly consist of hardware platforms that are integrated into OEM products as well as technology and software licensing.

Hardware

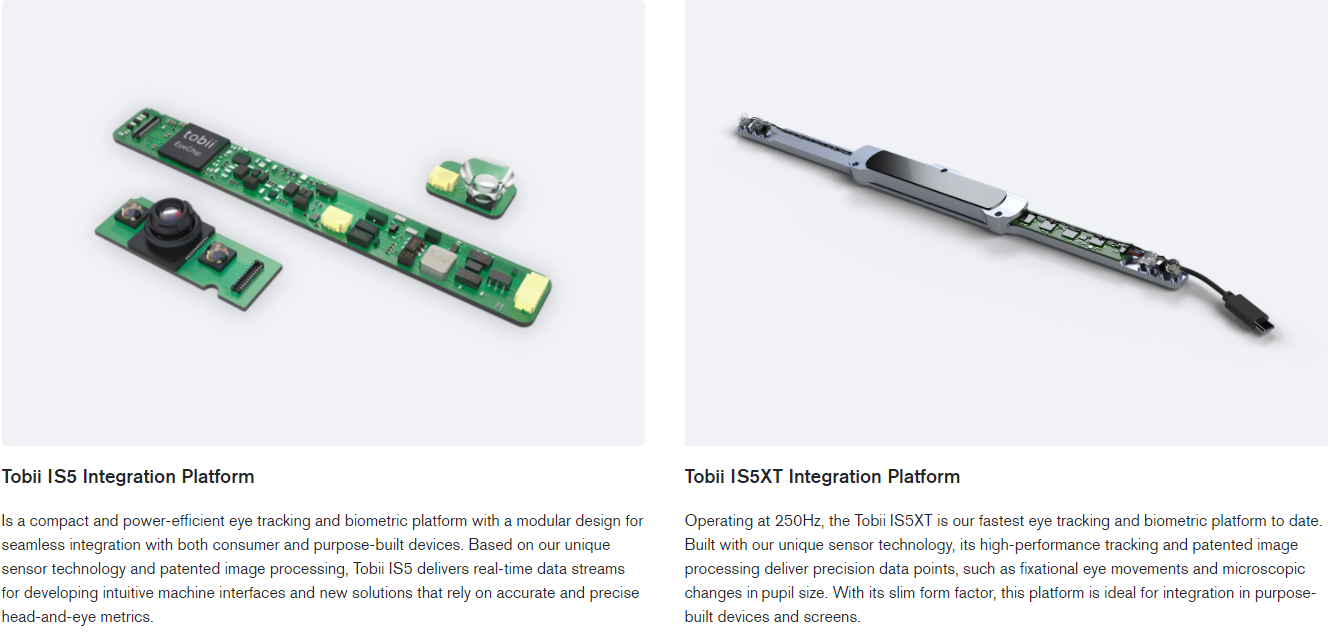

Integration Platforms

Screen Based

These are built into OEM products.

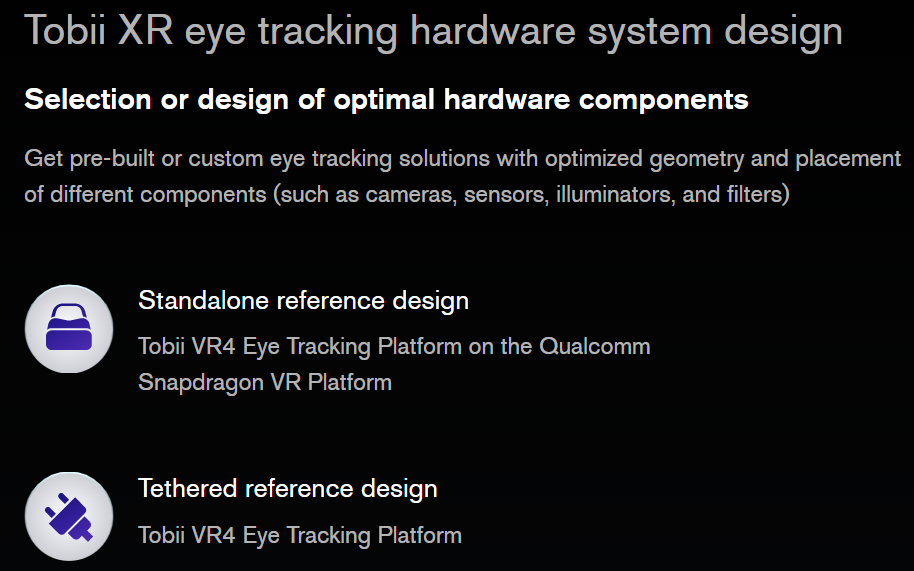

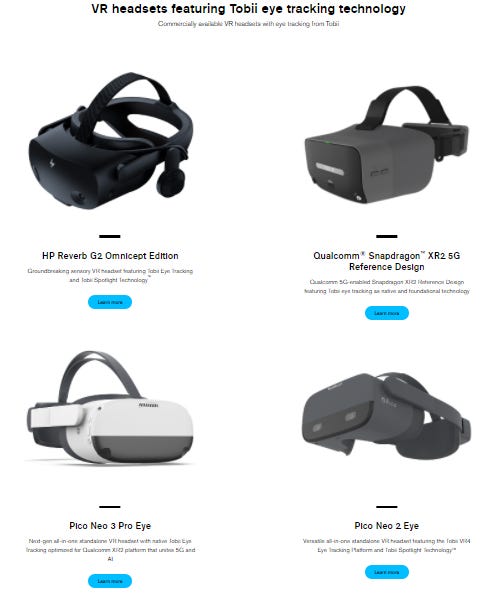

Virtual Reality

Tobii sells what is essentially “architecture” for virtual reality headsets…

as well as the brains (chips)

allowing VR OEMs to leverage off their eye tracking technology to advance virtual reality technology:

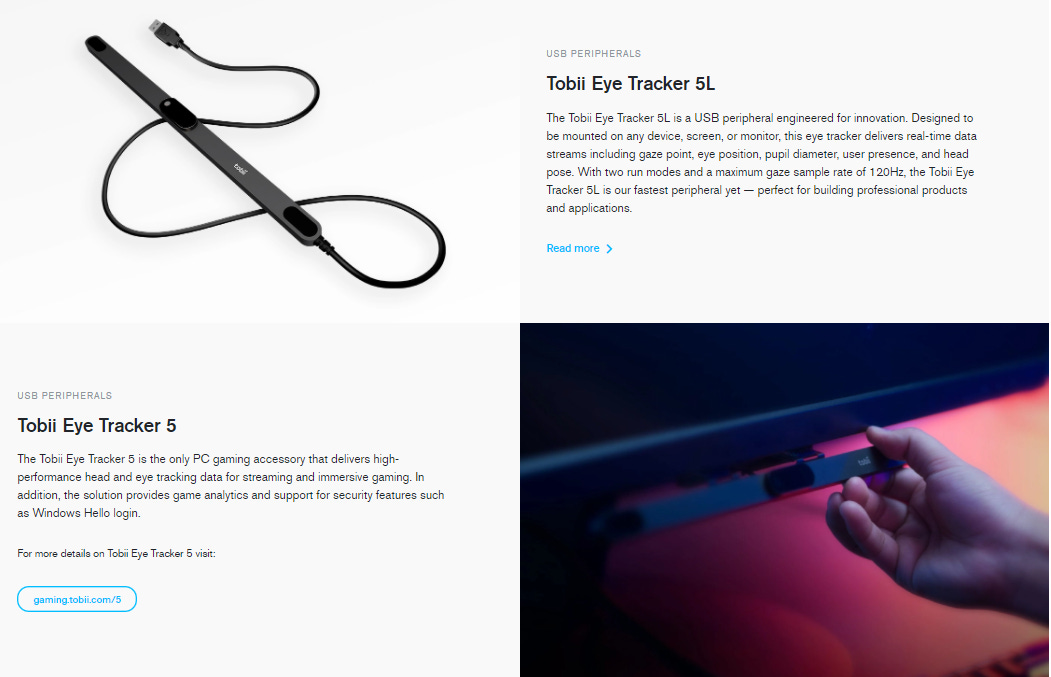

USB Peripherals

Quite self-explanatory here.

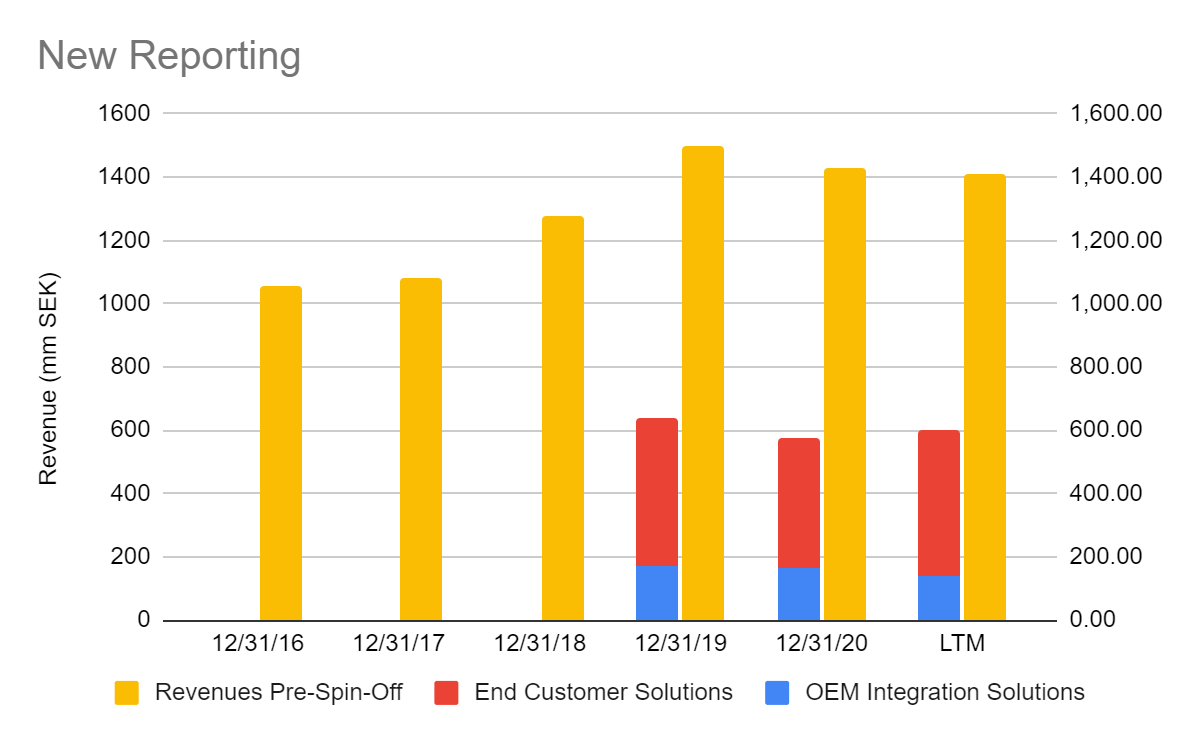

New Reporting

After the spin-off and organizational merger, revenues are now reported as End Customer Solutions and OEM Integration Solutions.

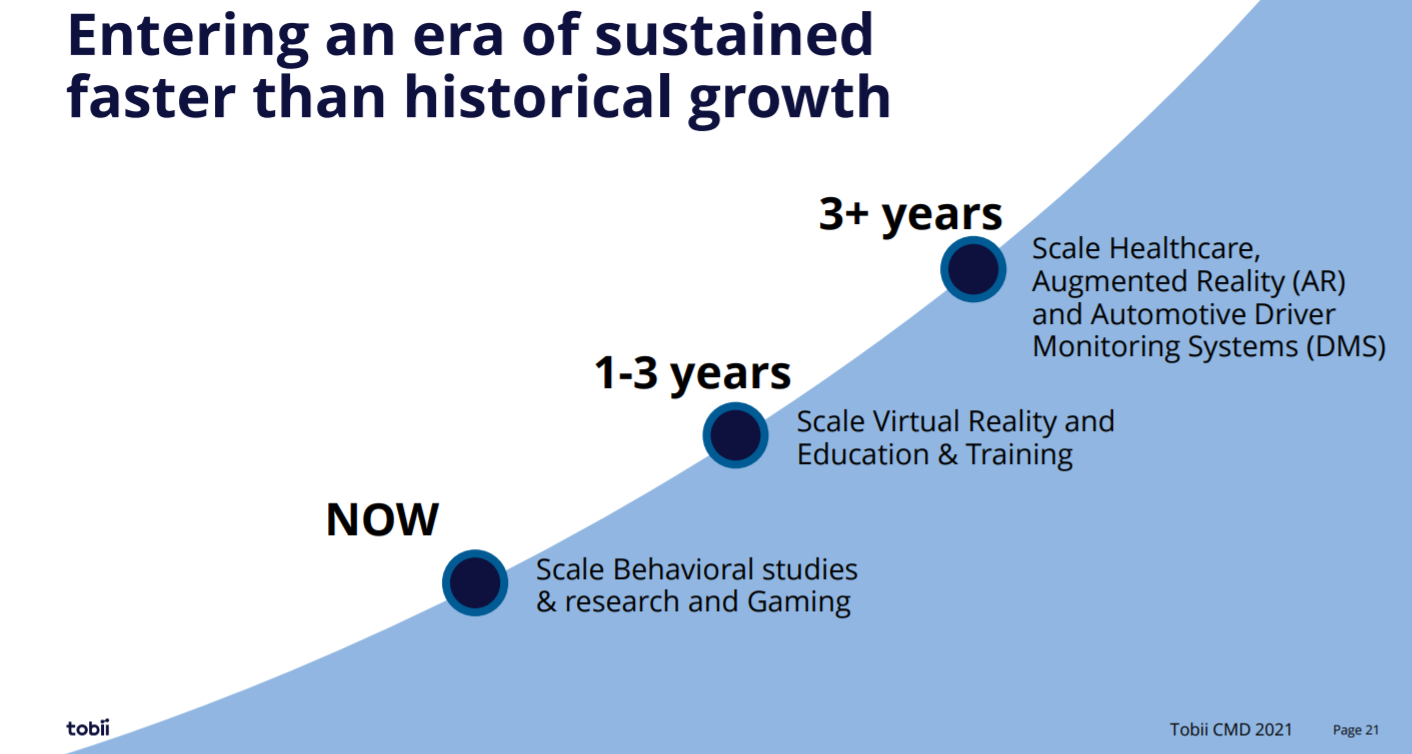

Growth Drivers

The next stage of growth for Tobii will be invest in and ride on the integration of attention computing into everyday devices such as PCs, laptops, mobile phones, tablets, as well as into more novel devices like Virtual Reality (VR) headsets and nascent technologies like Augmented Reality (AR) headsets. The company believes that the holy grail for attention computing lies in AR instead of VR, which I wholeheartedly agree with.

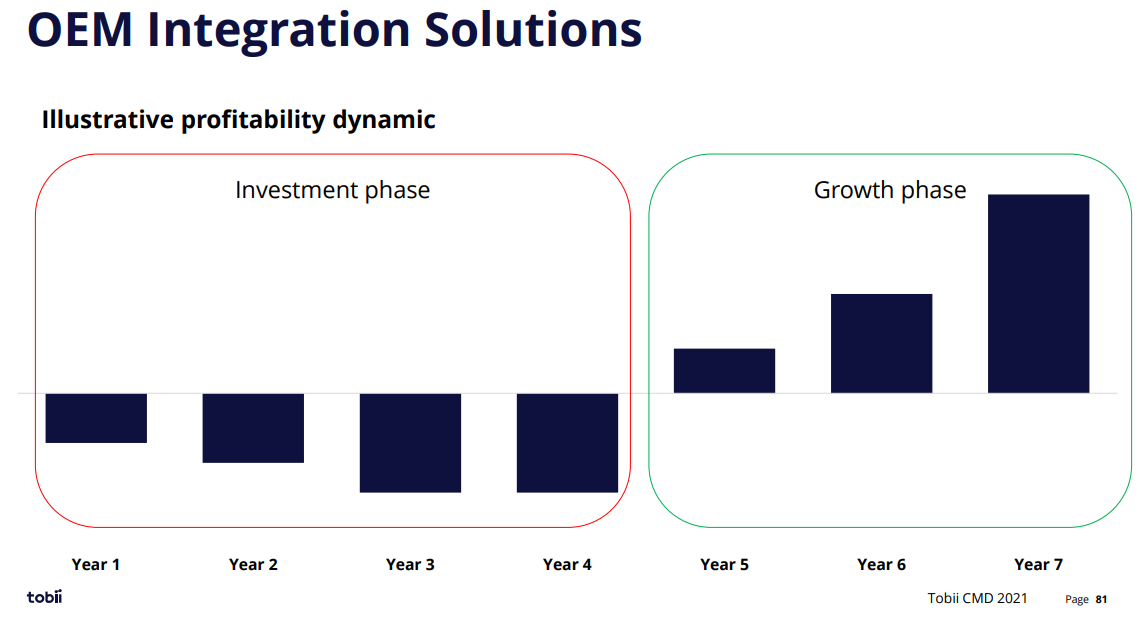

The integration business has a long drawn-out conversion process with a heavy up-front investment phase, consisting of a design process with numerous back-and-forths with potential clients.

As such, the Company expects that the bulk of the Company’s growth in 2022 to 2023 will come from the end-product segment before integration business ramps up an accelerates revenue growth further.

Arguably, the VR and AR markets are still in its nascent stages and it will be sometime it truly reaches mass market scale as suggested from Tobii’s Capital Markets Day (100M VR units /year and 1B AR units/year).

Conclusion

What is the Growth Profile of the Industry?

It is in a secular growth phase due to strong tailwinds in multiple relevant sectors:

Eye tracking will be the next tool of choice for marketers in the battle for attention

Augmented reality has strong potential to serve as a foundation for a large proportion of work in the future

What is the Moat Profile of the Industry?

The Company has a transient moat. Its dominant market share in the eye tracking market suggests that they have market-leading products. However, the type of products remain roughly the same with a number of competitors with products in the same category as well, suggesting that given enough time, competitors will eventually catch up with Tobii’s current product lineup.

This means that Tobii must continually invest heavily into its business to remain ahead of the pack. As Tobii appears to be the only publicly-listed eye-tracking pure-play company, capital should be the most abundant for the company, which will allow it to invest more aggressively.

That being said, with AR/VR expected to truly reach mass market status only by 2030, a lot can happen in between with competitors possibly catching up or even surpassing Tobii in the future.